Oil Breaches Key Levels Amid Economic Worries: A Bearish Signal for Markets?

By Chinedu Okoye

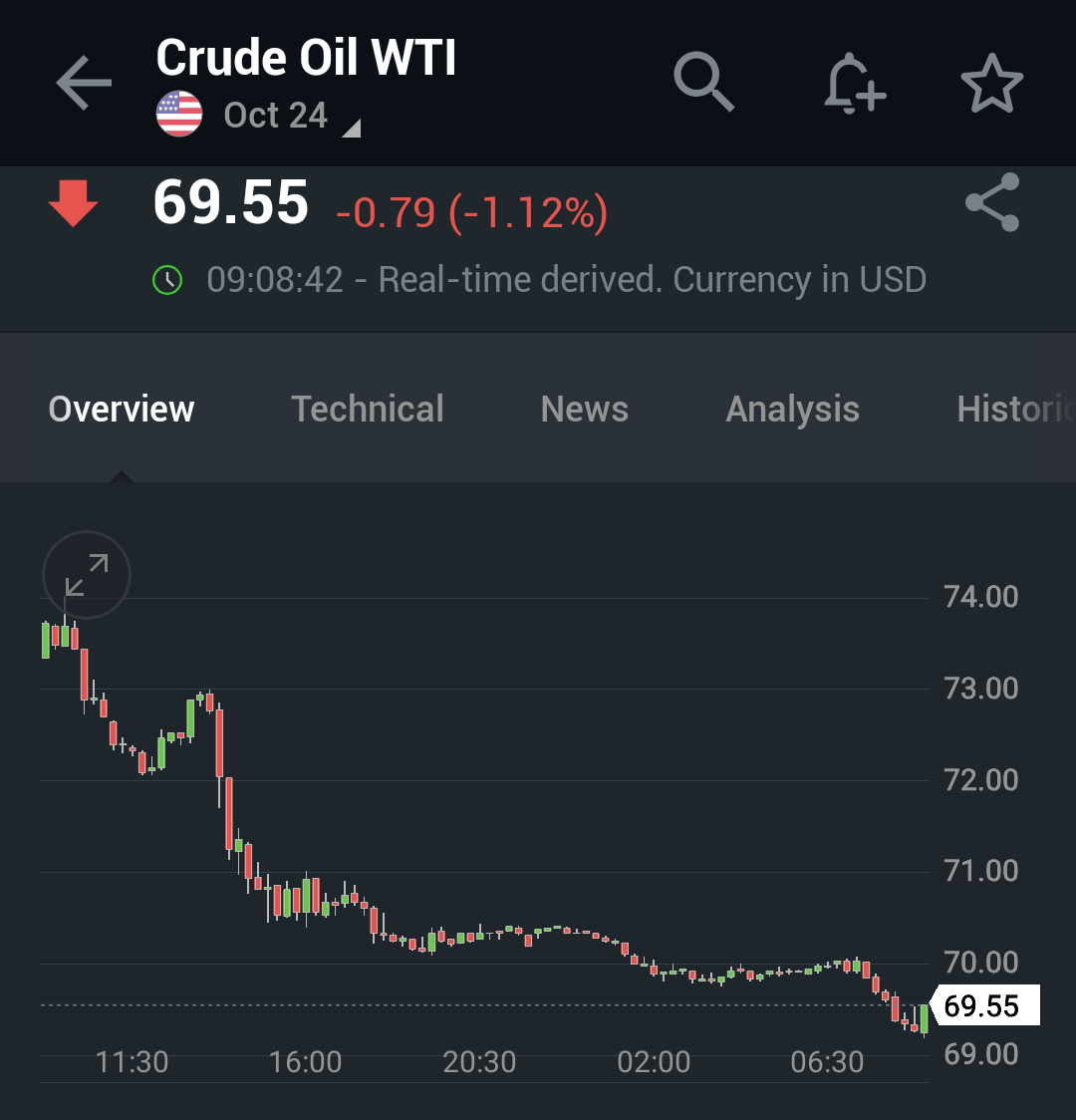

Crude Oil drops as both BRENT and WTI Breach Technical Support Levels:

As of today, Brent crude oil is trading at $73 per barrel, and WTI has dipped to $69, breaching the critical $75 and $70 thresholds, respectively. The slide in prices reflects mounting concerns about a global economic slowdown, particularly in China and the US.

Despite OPEC's efforts to manage supply, these concerns have overshadowed the impact of Libya's production decline.

Gold Drops but holds at Key Levels:

Gold, a traditional safe haven asset, has also faced market pressure but remains above key resistance levels, with XAU/USD at $2,480 and Gold spot at $2,511 per ounce. The relative resilience of gold compared to oil suggests that investors might be preparing for tougher economic conditions ahead.

If bearish factors continue to dominate, as seen in the current price trends, we could be witnessing early signals of an impending economic downturn. The combination of a resilient gold market and sustained weakness in crude oil could be a harbinger of broader market instability.

Whether this be the start of a broader market correction, or just a temporary blip is left to be seen.

Comments

Post a Comment